- blog

- Business

Since the onset of the pandemic, business and society have collided like never before. Whether you call it stakeholder capitalism or corporate purpose, there’s no doubt that brands have significantly increased their commitments to their communities. America’s 50 biggest public companies committed almost $50 billion to address racial inequity after George Floyd’s murder, and as of January, nearly 40% of the Fortune 500 are active in climate-based initiatives.

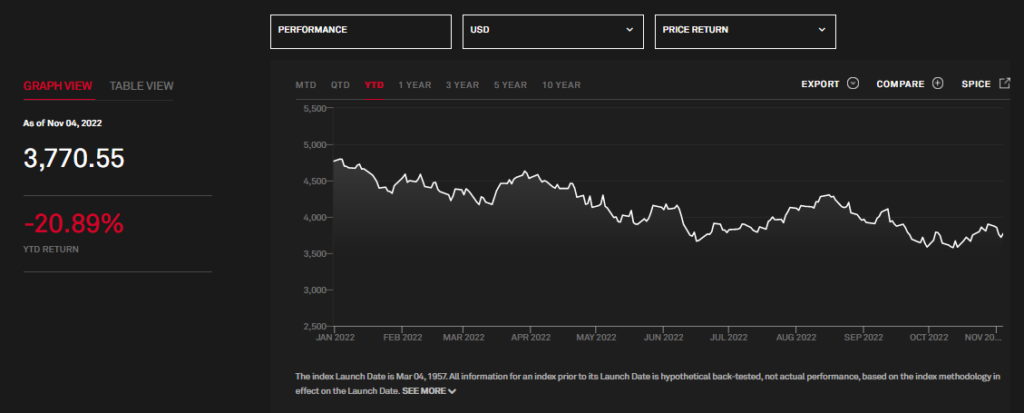

But these commitments coincided with strong economic growth. The S&P 500 doubled from March 2020 to January 2022. As such, the surge in demands from talent, consumers, and regulators alike made supporting social issues an easy business decision.

As we stare down the end of 2022 and what lies ahead, much has changed. As of publishing, the S&P has fallen over 20% since January with inflation on the rise. Politically, partisan vitriol and even violence are rising around the world with divided government and gridlock likely in the U.S. Meanwhile, geopolitically, the world feels more unstable than it has in generations. These forces have transformed even once-safe harbors like ESG into partisan minefields. The result is that every brand is cutting costs and re-evaluating which are essential investments.

Year-to-date losses from S&P 500 exceed 20% (Data from https://www.spglobal.com/spdji/en/indices/equity/sp-500/#overviewhttps://www.spglobal.com/spdji/en/indices/equity/sp-500/#overview)

Can our commitment to corporate purpose survive? I believe the answer is yes, but not from the altruism of rare courageous leaders. Across sectors, purpose investments will only survive if business leaders successfully demonstrate their short-term business ROI. Fortunately, our evolving environment presents three critical opportunities to do this with both precision and impact.

In all of these cases, the onus is on business leaders to demonstrate the ROI of purpose programs before the worst of the financial pressure hits. To do this, we must go beyond antiquated anecdotal arguments. Boards and CFOs need quantitative metrics in each of these areas. Fortunately for purpose initiatives, that is now possible.